It certainly is for me, despite my best intentions. Time is a commodity we can’t buy.

A quick search on Google suggests time is important in life because it allows us to accomplish tasks, make progress and achieve our goals. It’s also important for building relationships, enjoying leisure activities and experience new things.

I personally would like more free time, and I’m of the mindset that this is one of my main priorities moving forward – in part, why I have chosen the Employee Ownership Trust route for the company.

As we all know, one of the elements contributing towards one’s fulfilment is to have choices. This is what time allows. It’s also what good financial planning should deliver. Choices!

Some of us will be afforded lots of spare time but we have a choice as to what we do with such time. Undoubtedly, our fulfilment is heightened when we have a sense of purpose.

Time is a precious resource. We can’t get it back and so we should make the most of it in whatever guise.

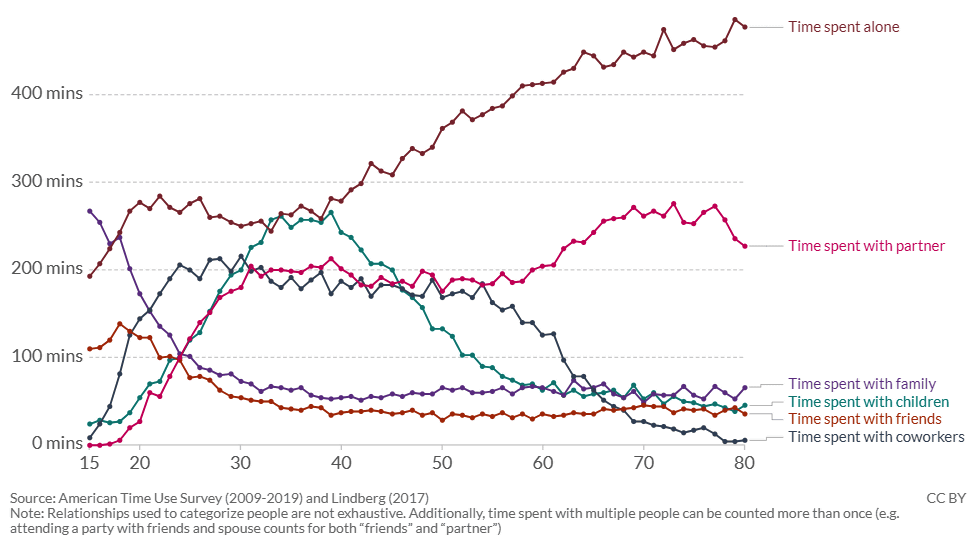

Take a look at the graph below. It’s fascinating and thought provoking. In some ways it’s quite sad when you consider the amount of time we are likely to be on our own in the future. Although this is data for the US, it will be pretty similar for the UK.

How Americans spend their time, by age.

Average time spent with others is measured in minutes per day, and recorded by the age of the respondent. This is based on the averages from surveys spanning 2009 to 2019.

I’ll finish off with a quote sent to me last week by one of my team members. They weren’t suggesting I’m miserable or anything, more an upbeat message to all the team after a very busy week.

“Wake up and greet the day with a smile. Be grateful for 24 brand new hours before you. Live fully in each moment”.

Thank you.

Gary

Gary Neild B.Sc.Hons. DipIP PFA

Chief Executive Officer (CEO)

Risk warning

Please Note: This communication should not be read as giving specific advice regarding your personal circumstances. This would only be given following detailed assessment of your individual needs. The value of investments may fall as well as rise; you may get back less than invested. Past performance is not necessarily a guide to future returns.